TP34. How taxes can be abolished? By David Mills

EXTRACTED FROM PRACTICAL POLITICS ISSUE NO. 206 APRIL 2014

PREFACE

On 22nd. May elections are being held both to the European Parliament and to local government bodies. On 18th.September, voters in Scotland have their referendum on whether or not to break away from the rest of the United Kingdom. In May 2015, a General Election is due to be held for the House of Commons at Westminster. There is also an election to the Scottish Parliament to be held in 2015 or perhaps in 2016. After the Scottish referendum, the Island Councils of Shetland, Orkney, and the Western Isles will be considering plebiscites on their own options vis-à-vis Westminster and Edinburgh.

In view of all this important activity, we consider now to be the appropriate moment to reassert the unique significance of land in economic analysis, setting out our approach to, and arguments in favour of,the policy of LVT, and including some specific illustrations of how its full and proper implementation can lead to the solution of economic and social problems. Some of the material will have appeared previously in “Practical Politics”and elsewhere,but the present form of presentation is new.

Most people who follow current affairs reasonably closely will at least have heard of land value taxation (LVT),and many of them will know that it is a means of raising public revenue from a levy on the undeveloped value of land. Beyond that,there is little real understanding of the policy and very little appreciation of its power to affect the wider economy and to make an impact on the lives of the population at large.

This essay does not set out to describe, or even to hint at, everything that there is to say on LVT. The subject is too vast for that. Instead, your editor has chosen to begin by explaining how the production anPandora Charms UK d distribution of wealth–which are what the science of political economy is all about–have arisen and grown. Of course it is extremely simplified, but the failure to grasp the basics (or the propensity to forget them) has led to the present frustrations and seeming helplessness which afflict policymakers and commentators alike. The editor trusts the reader will bear with him if it is though the has done the academice quivalent of describing how to suck an egg. Anyhow,the essay goes on to consider the implementation of LVT, and then to outline an appeal in support of the case for moving to adopt LVT as a central instrument of economic policy.

There is no shortage of information on the significance of land, but precious little systematic analysis on the rôle of land in the functioning of the modern economy.It changes hands for£millions, but simultaneously is treated by academe as having gone out of fashion!

OF WEALTH AND WAGES AND LVTweb Pandora Bracelets Cheap

LVT will have two obvious and direct effects on the pay packet. As a substitute for all or part of income tax, it will leave the earner with more money for consumption and investment; and insofar as VAT and other taxes on goods and services are abolished or abated, wages will go further. However,there is, in addition to this double-pronged benefit, a more profound way in which LVT will raise the general level of wages. To discover this, we need to look at the basic working of the economy.

Production

In the simplest economy imaginable, men and women adrift in a life boat come ashore on a hitherto uninhabited island. They set about surviving by picking fruit and nuts, tearing up plants for their roots, and scooping fish from pools with their hands. This is human effort (labour) directly applied to natural resources (land) to produce food (wealth). Later, they organise and specialise,and some of them produce a form of wealth which consists of tools (capital) which are not for direct consumption but instead are used to assist in the process of further wealth creation. At this point, labour, using capital, applies itself to land to produce wealth.

For all its complexity, the contemporary industrialised economy is no different. Human effort and intelligence,using tPandora Charms UK he most modern gadgetry and machinery, are applied to natural resources on a piece of ground to produce the goods we want. The three factors in production are still, respectively, labour, capital, and land, and what they produce is wealth (capital being a form of wealth diverted back to the productive process).

When wealth is divided up, it is helpful to retain the terms traditionally applied to the returns to the three factors of production.Thus labour receives wages, capital is paid interest,and what goes to land is rent. It matters not that these words maybe used differently and even inconsistently in daily life. This is a stimulus to us to think correctly when we analyse economic activity.The concepts then remain clear, even through a haze of verbiage.

Land and rent

In the first stage of our simplest economy,the surface space of the earth is freely available to all. There is so much of it and there are so few people that one spot seems as good as another. Later, though, as the society expands and develops, certain land is seen to be more desirable than the rest, because it is more fertile or better situated. The more the economy develops, the greater is the significance of location. Lush valley pasture suits dairy farms, and the fertile rolling plain favours cultivation of cereal crops; factories locate where there is an adequate power supply and where there are facilities to bring raw materials in and send finished goods out; shops and banks do better business in the main street than up a side turning; offices for administrative and commercial purposes tend to set up in quarters of their own; the best houses are in prestige areas in the centre of town or on salubrious suburban hillsides. Each site has advantages and disadvantages in relation to all other sites. Sites can command a share in the distribution of wealth. Land commands rent, in other words.

Rent, the return to land, is a leveller. It skims off the advantage which a site has in relation to the poorest land in use. The greater the differential between the least attractive land in use and the best, the higher the rent of the latter. What is left after rent is paid, goes in wages and interest. At the margin, on the poorest land in use, rent is nil (or virtually so). The general level of wages is set at this margin of production. Interest will be at what ever level is necessary to induce people to defer consumption and allow some of their share of wealth to be diverted to capital formation.

Government

By now, it will have become evident that the expanding society has certain administrative and other needs which it is generally accepted are best provided as an overall public service, for example a system of law and order. The necessity to establish the machinery of government raises the question of how it is to be paid for. Fortunately, the means are available. It has been noted that sites now command rent. Obviously the owners could not individually have been responsible for bringing this about, for it is seen to stem partly from the natural advantages of one location over another, but in particular from the expanding economic activity of the community as a whole. It is therefore decided to collect land rent to fund government requirements.

The consequence of this simple decision is that good land will be fully and creatively utilised and that wages go without tax deduction to those who provide their labour. As population expands and the economy grows, discoveries and inventions boost productivity. Greater wealth leads to higher wages; but rent also rises as increased economic activity brings formerly marginal land into production, providing government with a buoyant source of revenue from which to meet its increased commitments.

That is what should have happened. What has gone wrong is that land has been privately appropriated.

What has gone wrong

The rent of land has been diverted to their own use by landowners, individual and corporate. Public finance has had to be raised from taxes bearing on labour and capital and on the goods and services they produce. Because no cost is incurred in holding land out of use altogether or in mis-using it at well below its productive potential, hoarding and speculation have been encouraged. Reducing the amount of land on offer has brought about scarcity and raised the price of land that is available. Labour and capital, denied some of the choicest sites, have been forced to go to what ought to have been left as sub-economic land. Put in another way, the margin of production has been artificially lowered.

We have noted that the general level of wages is set by what can be earned at the margin. The extra share of wealth taken by landowners comes directly out of that portion that should be going as wages.

How to get a pay rise

If we rely on our efforts by hand or brain to make a living for ourselves and our families, whether what we take home is called a wage, a salary, or a fee, we are receiving much less than our deserts. An annual levy to collect the unimproved site value of the land would set matters to right. Apart from permitting replacement of present taxes, this simple arrangement would remove the attraction of withholding and making poor use of land, and would take away the landowners’ ability to force up the cost of access to a plot of ground before any productive work can begin. It would raise the margin of production.

In a complex, diverse modern economy, there are of course many differing pay scales for differing skills, and these will vary from time to time and place to place. The introduction of LVT, though, would impact directly on the general level of wages at the stage of the primary distribution of wealth. Attempting to re-distribute incomes and benefits after a failure of this magnitude at source, is mistaken. The system deployed by the modern state is costly, inefficient, ultimately ineffective, and wholly unnecessary.

LAND, PRODUCTIVITY, WAGES, and the MARGIN OF PRODUCTION

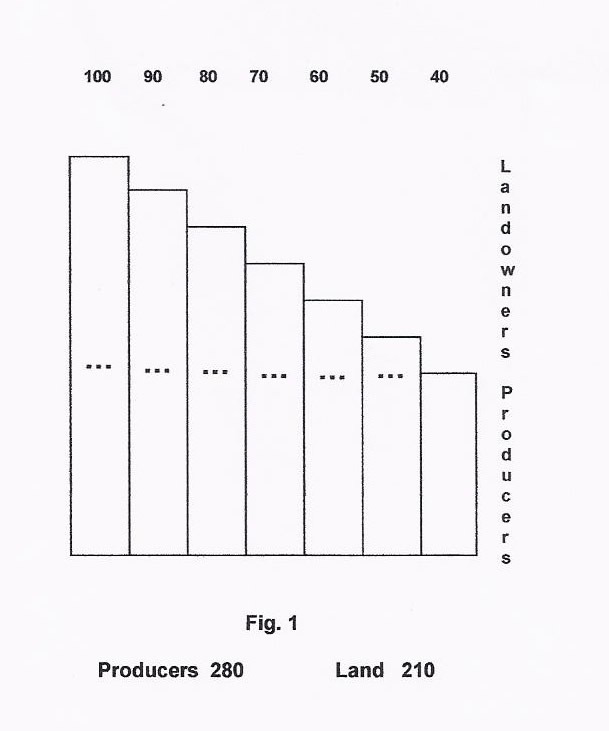

In the simple economy we have imagined above, people would start by occupying the best land, then fan out to use the second best, third best, and so on. Figure1 shows how land producing 100 units of wealth is taken first,

then 90, 80, 70, 60, 50, and 40. At this point, a new arrival can either work for himself on land where he can produce 40 units or he can accept a wage and work on better land for someone else. Thus, a land owner who has land capable of producing 70 units will need to pay at least 40 to attract labour, but he can still keep the other 30. On 90-unit land, the owner still need pay only 40 in wages, and can thus keep 50. On 40-unit land an established owner could command no rent from a new comer because the latter could make 40 working for himself on the free land still available.

Rent, the return to land, is, we noted, a leveller. It skims off the advantage which a site has in relation to the poorest land in use. The greater the differential between the least attractive land in use and the best, the higher the rent of the latter. What is left after rent is paid goes in wages and interest. The general level of wages is set on the poorest land in use, at the margin of production. Interest will be at what ever level is necessary to induce people to defer consumption and allow some of their share of wealth to go to capital formation.

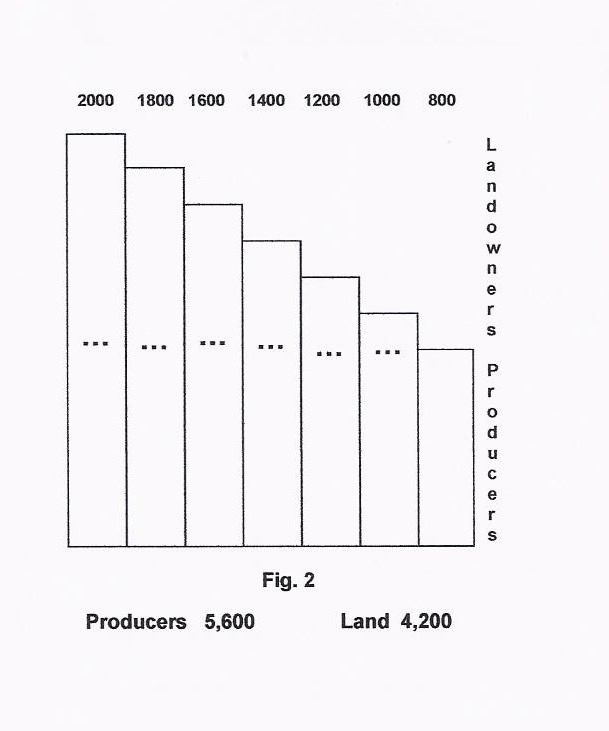

Figure 1 is obviously over-simplified. As population expands, the division of labour, discoveries, inventions, and greater use of capital bring about a significant advance in productivity. This is shown in Figure 2 where all the numbers in Figure 1 have been increased twenty-fold. At the margin,producers now have 800 units instead of 40. The old 100-land now yields 2,000 units, of which rent takes 1,200, because the margin still inevitably determines what need be offered in wages.

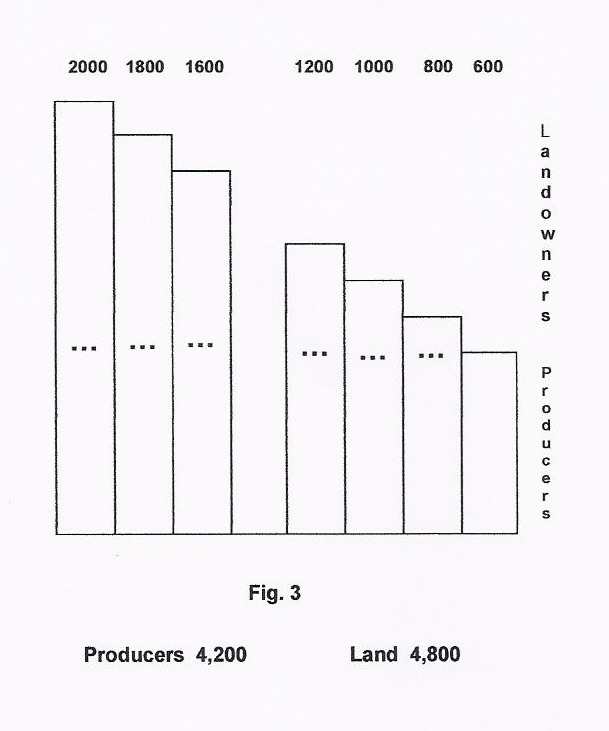

Figure 2 shows too optimistic a picture, unfortunately. In reality, where land is privately appropriated, owners hold some out of use for speculative or other reasons, or do not trouble to use it efficiently. For illustrative purposes, let us represent this by assuming that all the owners of 1,400-land simply refuse to allow any of it to be put to use at all. This has the effect of making people go from the 1,600-land straight to the 1,200-land, with a knock-on effect, so that those formerly on 800-land are forced to go to previously sub-marginal land yielding only 600 units for the same application of labour and capital. In this way, the general level of wages is depressed from 800 to 600, as shown in Figure 3, and land rents rise accordingly: the owner of 2,000-land now collects 1,400 for himself.

Not only does total production decline, from 9,800 units to 9,000 units, but there is also an actual shift in the distribution of wealth away from the active producers (5,600 units down to 4,200) in favour of the passive landowners (up from 4,200 to 4,800). The margin of production is critical in determining how wealth is divided.

None of these figures has absolute validity, but they do illustrate very well how we allow our affairs to be managed to-day.Capitalism is perverted and distorted by private ownership of land. Worse, government , having shamefully deprived itself of land rent as the obvious and logical source of income for public revenue, finds it necessary to clobber all manner of noxious taxes on legitimate earnings, savings, goods, services, and trade.

The introduction of LVT, implemented rapidly and with determination to the point where virtually all the annual rental value of land is recovered, would be an act of primary justice in itself,and would automatically boost productivity, raise the general level of wages, and permit the remission of existing taxes.

LAND OWNERS AND LAND OWNERSHIP

Land is a simple concept in political economy. It is the earth’s surface and resources minus man-made improvements, the whole of the material universe outside of man and his products. Land is a gift from Nature. A landowner is thus one who arrogates to himself a portion of land and converts the rent (the share of wealth the land commands) to his own personal use.

A landowner maybe one person, a group of persons (such as a partnership or a co-operative), or a limited company.

A landowner may as an individual also perform labour for a wage and provide capital in return for interest. However, the functions of landowner, of labourer, of capitalist remain distinct.

One who enjoys a beneficial interest in land may also be considered a landowner even if he is not the freeholder. Anyone who took a 49-year lease on land in 1945 under a fixed-money rental agreement, must surely have been enjoying a far greater share of the land value than the freeholder was by the time the lease had run its course. The term, landowner, refers to the total package of ownership, however its benefits maybe divided and sub-divided.

Land was here before man and doubtless will be here after him. The function of land ownership serves no useful purpose. No one needs to own land for any reaso nexcept to exploit others by appropriating the common rent fund. All one needs is security in occupation. This is guaranteed by LVT, in that annual payment of site value to the exchequer gives the right to exclusive use of the piece of land in question–with no taxation of improvements or of the processes or products of industry.

LAND OWNERSHIP AND CAPITAL

In prevailing circumstances it is difficult for those who earn their living by work to accumulate sufficient wealth to enable them to become significant owners of capital. It is the landowners who are more likely to have wealth in surplus and thus become the suppliers of capital too. Because the same people and corporations often fill the rôles of both landowner and capitalist, there is a tendency for some observers to obscure or ignore the difference.

Thence spring errors of economic analysis and faulty political programmes.

MORE ON WHAT LVT IS AND WHAT IT INVOLVES

This planet was not made by man. In the terms of political economy, it is not a product, not merchandise. What, then, can possibly be the ethical claim to outright private ownership and control of land? It is at least as feeble as the case for chattel slavery. If it is right that some may own the Earth to the absolute exclusion of all others, it must equally be morally right for everyone else to be born landless. Did the Creator so intend? Or are all men to be deemed born withequal rights, with the equal opportunity to exercise their admittedly unequal personal gifts, qualities, and inclinations? The origins of private appropriation of land lie in force and fraud, aggravated when apparently sanctioned under a civilised veneer.

In most of the world to-day, those who provide their labour (and those who provide capital, which is no more than goods previously produced by labour and now recycled to assist in the productive process) must pay landowners for the right to use of a little plot of Planet Earth as living, working, and recreational space– the very space on which they must toil to create the wealth from which the land- rent is drawn. Then the state, needing revenue and having thrown away the rental value of land, turns to tax the fruits of labour, so that labour pays twice, once to the landowner and again to the state. People expect to pay for the benefits, natural and social, afforded by the sites they choose to occupy to the exclusion of their fellow men, but paying once is enough!

Land values reflect collective current demand for access to what Nature has provided free, together with current levels of, and trends in, the economic and social activity of the community as a whole. Only incidentally are land values historical. They must be renewed on a daily basis, and generally they will depend too on perceptions of future economic activity and the maintenance of political and social order.

When LVT comes in,no one’s land is to be seized and no title deeds taken away. No landowner (rural or urban, individual or body corporate)is to lose anything he himself produces – indeed, the income land holders earn from their labour and the provision of capital goods will be tax-free. What is envisaged is a national land-rent charge to return to the community that which belongs to it.

IMPLEMENTING THE NATIONAL LAND-RENT CHARGE(“LVT”)

At the out set it is essential to distinguish the meaning of the word, land, as traditionally used in political economy, from its legal meaning of fixed hereditaments. The concern here is with land as terra firma, as location, but taking into account its mineral resources and other natural features. Buildings and other developments in, on, over, or under the land surface of each plot are ignored for valuation purposes, although in each case the surrounding area is taken to be in its existing state of use and development. Land is valued on the assumption of optimum use within planning and other constraints (be it noted that the optimum may be lower than the maximum permitted).

We record, in passing, that land in economics includes the air, rivers, lakes, and territorial waters as well as terra firma; but these are more conveniently treated in separate legislation, applying the same principles.

The civil service can be relied upon for competent drafting of the legislation, provided the government of the day gives clear political direction. It would also be wise to work closely with valuers during the progress of the legislation. Implementation will no doubt raise transitional questions– but which of to-day’s taxes is so perfect? LVT is a replacement for current taxes.

The applicable circumstances at the time legislation is brought forward are not readily foreseeable now. This makes it a somewhat sterile academic exercise to produce a detailed draft to be put away in the desk drawer just in case it should be needed in the middle of next week. Of course it could happen like that, but a less optimistic view might suggest several, even many,more years of campaigning. What will the state of the country be then? How far will devolution have gone? What will local government be like and what will be its powers and responsibilities? What happens as offshore oil and gas revenue declines? What state is “Europe” in, and where is the U.K. in relation to this “Europe”? How many wars will there have been, how many will the U.K. have become embroiled in, and in what political and economic position does the U.K. find itself in consequence? Is Westminster voting still “first past the post” or will there be some form of proportional representation? If so, will it end violent swings of “in” and “out” and encourage consistency in fiscal policy, or will it paralyse progress in coalition compromise? Where does inevitable change leave the party system, and what is the mood of the general public? The principle underlying LVT, the fundamental aim in introducing the policy, and the broad issues involved in implementation, are already known or readily deducible. The finer detail of the legislation must await the event.

Launching the system

LVT will be brought in as an annual percentage levy on the rental value of land. The lower the percentage of land value that is taken in LVT, the more is left behind with the landholder. All the evil consequences of land rent appropriation will still be present (with holding and under-use of land; extortionate prices; taxation of labour and capital and of the goods and services they produce; unjust distribution of wealth; periodic bouts of unemployment; the cycle of boom and slump). Especially if the percentage is low, and even more so if there is no expectation that the percentage will be increased or if there is belief that the system may in time be dismantled, the macro-economic benefits claimed for LVT will not materialise.

Land is a natural monopoly. Its supply for practical purposes cannot be increased, nor can it be transported from where it is almost worthless to a location where it is scarce and costly. Its market price is thus apt to contain an artificial speculative or “hope” element. Land value, if measured nationally to-day,would therefore, inaggregate,be found to be too high.

The aim at the time of the first valuation is to launch the system. It will greatly help if the number of appeals is kept down. Tending initially to undervalue is thus likely to cut the number of complaints of over-valuation whilst also recognising that the advent of LVT will in any case knock some of the “steam” out of the land market by encouraging the bringing of derelict land into use and the better use of land currently under-used. Concentration of effort need not therefore be on seeking perfect accuracy of current values, but rather on attaining correct relative values. The important task is to get the differentials right by consistency in the under valuation, so as to limit appeals, as far as possible, to questions of comparability. Further to cut down frivolous appeals, landowners who complain that the valuation figure set on their land is too high, maybe required to market it (giving public authorities first option) at their own lower assessment of its value.

LVT, then, acts at first to reduce over all land value. It halts and indeed reverses the process of forcing producers to by-pass comparatively good land and set upon land that ought to have been left marginal. Raising the margin of production raises the total wealth output, by using only the most favourable locations. It raises the total going to labour in wages, and it lowers the total that goes to the holders of land (by operation of the economic Law of Rent, as illustrated above,page 5).

Land is today seen as a good investment. LVT reduces its (land’s) attraction in this respect, because it takes part of the land value as a national land-rent charge, leaving less to be capitalised in buying/selling price. Even future windfall gains from planning permission or major infrastructural investment will be at least partially taken away (depending on the rate of LVT).

This will likewise act to dampen speculative “investment” inland. The tendency is thus to bring land values down still further. This tendency will be accelerated if it is widely accepted that LVT is here to stay and that the percentage levy will be progressively raised.

Spread of benefits from progressive implementation

As LVT is increasingly applied and its benefits flow through into the economy and society generally, taxes are taken off labour and capital, off the processes of production and trade, and off the consumption and accumulation of wealth. Without this burden of contemporary taxation, land that is now economically marginal and even sub-marginal will be able to sustain a livelihood and will be brought into economic use. At present, some activities are killed because production does not provide a living wage or are turn on capital after taxes like VAT and motor fuel duties have been paid. LVT, by contrast and by definition, is very low just above the margin and zero at (and of course below) the margin.

If the initial effect of LVT is to raise the margin and reduce the land value total, the secondary effect goes the oppositeway: it encourages new activity beyond the revised margin back out towards (or to or perhaps even further than) where it was in the bad old days, but this time with added production, added prosperity, added employment prospects, added opportunities for deployment of capital, and a more just society.

LVT in its fullness – and the ills it has to meet, beat, and replace

During the transition period, the yield from LVT will inevitably be partial, though increasing. At the same time there will still be legitimate demands on the state which are the consequence of current policies and practices.

Pensions are an example: a 20-year old can be told there will be no old age pension from the state, but one can hardly say that to a 55 – year old who has had a life time of struggle in low paid jobs with several periods out of work altogether. While this situation of partial LVT and residual welfare demand continues, contemporary taxes will have to remain, albeit at declining levels.

The time will be reached when transition is complete. It will almost certainly have become obvious by this stage that all taxes come ultimately at the expense of land value. Removing remaining taxes of the contemporary sort will therefore lead to a further rise in total land value, at which point the total land-rent fund (as LVT would then have become) would beat least enough for normal peace time public revenue requirements. Let us follow this line of thought.

For this purpose we may disregard capital and interest. The rate of interest is whatever is necessary, allowing for time and risk, to induce people to provide capital instead of devoting their income to immediate consumption.

We therefore concentrate on labour and wages and on land and rent. Into-day’s imperfect society, rent is privately appropriated. Some land is withheld from use; much more is under-used. The margin of production is depressed, leading to artificially low productivity. Distortions follow. With less good land available, rents and prices rise. This induces use of capital to mitigate shortage of affordable land (for example, intensive agricultural methods, high-rise buildings, urban sprawl and the need to invest in extended supporting infrastructure and facilities). All this is economically wasteful. Wages are depressed, literally to subsistence level in backward economies controlled by ruling cliques owning all the best land, but in advanced “western” economies to a level of general decency which will ward off civil unrest and the threat of rebellion.

With wages of general labourers held at the lowest socially acceptable levels, it follows that all taxes must come, can only come, from what would otherwise be captured by the beneficial owners of land. Superficially this is not so. Personal and corporate incomes are taxed. Private possessions are taxed (for example, by the council tax and the UBR). Goods are taxed in the course of trade (for example, import duties and VAT). In practice, however, take-home pay and what it will buy are what count, and, with an inevitable time lag, personal taxes are pushed back to the employer, and the employer has to draw the line at what he can now afford to pay for land.

Of course it is more complicated and more wasteful than that. Business will try and pass its higher labour costs on to the consumer and will then have to cope with the demand for higher pay. Consumers will mean while have to cut back on what they can buy and/or will turn to cheaper imports and/or to substitute goods. Business faced with higher labour costs will look to use of machinery in place of men. Rising unemployment leads to higher welfare bills, obliging the government to raise taxes and so give the merry-go-round a further spin. A retailer can afford only so much in outgoings if he is to survive, so that a UBR increase reduces his capacity to pay a landlord’s demand for a rise at rent review time. If the landlord insists, the retailer has to quit. The landlord has an empty property on his hands until he recognises he has to come back down and, in effect, absorb at least some of the UBR increase. Meanwhile society at large is the loser, for the tax receipts are down, the landlord has idle capital (the shop structure), the retailer is out of a job, and the public loses a shopping facility. On land at and just above the margin of production, there is, as we have seen, either no land value to bear any increase in conventional taxes or insufficient to bear all of it. Since wages are already at the lowest acceptable level, further tax renders work uneconomical, production ceases, jobs are destroyed and capital made redundant.

Where taxes do go down, land does absorb the benefit. Abolition of domestic rating (a property tax) in favour of the community charge (levied on the person) gave an instant, presumably unintended boost to “house prices” (housing land prices) that were already spiralling upwards in the mid and late‘80s. Successive UBR revaluations have shifted the incidence of the rate both geographically and between different classes of non-domestic property: beneficiaries have found themselves faced by stiffer rises at rent reviews than they would otherwise have expected. Almost all taxes do come ultimately from land. If there are exceptions, they are single, isolated, unexpected levies like “wind fall taxes” and perhaps duties on accumulations of wealth like inheritance taxes.

That word, “ultimately”, is important, because in the meantime any tax increase has to be carried by the wage earner (or the retired or unemployed or welfare benefit recipient); and while the effects of conventional taxation are working through the system – a process which can take years in many cases – in justice and the maldistribution of wealth persist, damaging the nation to its very core.

Concluding challenge

It would be an exaggeration to claim that the national land-rent fund must amount to to-day’s tax burden plus to-day’s land value,but it must be a huge figure all the same, well in excess of either of these elements alone. This natural fund has been created by, is sustained by, and is usually progressively increased over time by, the collective economic activity of the citizenry. Why give it away? The result is to pay once for access to land to live and work on, and then to pay a second time in the form of conventional taxation to fund government revenue needs. Why?

Since the late 19th. Century, LVT, site value rating, and other forms of land taxation (all of the latter unsound in theory and ineffectual or worse in practice) have rarely been out of the political consciousness here and abroad (especially in the old Empire and Commonwealth). The land question is as old as the Physiocrats and formal economics itself. No one participating in or entering the land market can legitimately plead ignorance. Land holding does not take place in a historical, political, or indeed moral vacuum.

Postscript

In the foregoing, several references have been made to the economic margin. There is of course a true margin, beyond which all production is, at anyone time, uneconomic. This is the margin which has been used here for illustrative purposes and for simplicity and clarity. There are, however,many margins within this ultimate margin. The value of a plot of land depends on the advantages, natural and social, which its location offers. Very few classes of potential user can afford the best sites, much as they might like to have them, because they cannot conduct profitable business from them at the assessed rental value. In short, the site offers advantages which these would-be producers or traders cannot make full use of. Conversely, there are sites which most businesses will not use, even at an annual rent of 5p, because the locations suffer so many disadvantages that costs of production and distribution far offset the cheapness of land. In cases like this, producers need the advantages of much better locations and are willing to pay for them. The land market, freed from distortion by national land-rent collection (LVT in its fullness), simply allocates use sensibly and fairly according to who is best suited to exploit profitably the advantages of each unique location. Within this framework, a pattern of margins will be discernible for each trade and for each sector within each trade. References to the interaction between the economic margin and the with holding and under-use of land, and between the economic margin and taxation, are to be read with this greater complexity in mind.

In our next Issue, No.207,we shall be including some further backing for our case for the taxation of land values (perhaps more accurately denominated a National Land -Rent Charge– but LVT will do, for the time being!).

DEFINITIONS

“Practical Politics” aims to use a small number of words with the meanings attributed to them by the classical economists:-

Land: All the material universe outside of man and his products. Land thus includes rivers, lakes, the sea, and the air, as well as the land surface and what lies beneath it. In most applications, though, land will obviously equate with terra firma, with site and location.

Labour: All human exertion, mental or physical, directed towards the production of wealth.

Capital: Both wealth used in the production of more wealth, and wealth in the course of production and exchange. Capital thus includes intermediates and stock-in-trade, as well as such items as tools, machinery, buildings, and vehicles used in the productive process.

Rent: The return that is due to land when wealth is distributed. The share of wealth that is attributable to the superiority of any piece of land over marginal land.

Wages: The share of wealth that is the return for labour.

Interest: The share of wealth that is the return for the use of capital.

Margin of Way out in the wilds there is land that has no economic production: value: it is termed sub-marginal. Then there island that can be used for economic purposes only if no charge is made for its use: it is known as marginal. All the rest is sufficiently suited for economic use for charges to be leviable for the privilege of making use of it: this land yields what in political economy is called rent.

Parliamentary definition of site value, taken from section 3 of the London Rating (Site Values) Bill, 1938-1939:-

The annual site value of al and unit shall be the annual rent which the land comprising the land unit might be expected to realise if demised with vacant possession at the valuation date in the open market by a willing less or upon a perpetually renewable tenure upon the assumptions that at that date –

(a) there were not upon or in that land unit–

(i) any buildings erections or works except roads; and

(ii) anything growing except grass heather gorse sage or other natural growth;

(b) the annual rent had been computed without taking into account the value of any tillages or manures or any improvements for which any sum would by law or custom be payable to an outgoing tenant of a holding;

(c) the land unit were free from any incumbrances except such of the following incumbrances as would be binding upon a purchaser–

easements; rights of common; customary rights; public rights; liability to repair highways by reason of tenure; liability to repair the chancel of any church; liability in respect of the repair or maintenance of embankments or sea or river walls; liability to pay any drainage rate under any statute; restrictions upon user which have become operative imposed by or in pursuance of any Act or by any agreement not being a lease.

“works” does not include any works of excavation or filling done for the purpose of bringing the configuration of the soil to its actual configuration;

“road” does not include any road which the occupier alone of the land concerned is entitled to use.

____________________________________________________________________________

May 2014 Issue No. 207

In our previous Issue, No. 206, faced with several important electoral consultations, we presented the case for annual collection of the rental value of all land, first to abate and then to replace existing forms of taxation. As promised then, in this Issue we provide further supportive material.

TAXATION – A CLEAR DISTINCTION

Using the term

land value taxation to describe the annual collection of the rental value of all land, does the policy a dis-service. The justification for allowing such a usage is that, in the U.K., that is how, historically, it has been known. In the early years of the 20th. century, there were, successively, the Land Values (Scotland) Bill, 1907, the Land Values (Scotland) Bill, 1908, and the Finance (1909-10) Act, 1910 (which introduced a number of land taxes, none of them actually land value taxation, even though the preliminary campaigning had indeed been for proper LVT!). Later, Section III of the Finance Act, 1931, was entitled Land Value Tax. For well over a hundred years, there have been numerous inquiries, in and out of Parliament and Whitehall, referring either to land value taxation or to its local government equivalent of land (or site) value rating.

Yet, equating LVT with taxes such as income tax, corporation tax, the council tax, the uniform business rate, capital gains tax, value added tax, import duties and excise duties, is to underestimate the superiority and singular character of the former. All of the latter are taxes on work – on the productive process itself or on trade in goods and services or on accumulated savings devoted to capital formation.

Land is not man-made but is a gift from Nature, part of our planet, Earth. No one paid to have it produced!

What each plot is worth, depends on the demand for its qualities, for the social and other benefits and opportunities it offers. Each plot constitutes a monopoly location.

Properly and, as far as practicable, fully implemented, an impost based on the assessed rental value of land is to be viewed as a payment to the community for benefits actually received. What the landholder pays to the Exchequer is thus compensation for what he gets the exclusive right to enjoy.

Although generally known as LVT, this policy is more accurately described as a National Land-Rent Charge – the collection of the rent of land for public revenue purposes, to be effected by passage of a National Land-Rent Bill.

THE BASIC CASE FOR THE NATIONAL LAND-RENT CHARGE (“LVT”)

The moral, ethical argument

Whether there was a formal Creation or not, whether there was a Divine Creator or not, it is indisputable that the Earth was not made by Man.

From this it follows (i) that all men have equal rights in the bounty of Nature; and (ii) that no man can with moral legitimacy lay claim to private ownership of any part of that which Nature has freely provided. These principles are universal. Our immediate concern, however, must be to ensure their application where we have the political authority, namely within the United Kingdom.

We use the term, land, to mean the material universe apart from man and his products. The exertion of labour by man is what confers legitimacy on the claim to ownership: a man may not own what neither he nor any other man created.

The economic argument, from observation and inference

The value of land is of course influenced by such purely natural factors as the terrain, soil type, climate, and minerals. It is, though, the presence and activity of the population as a whole which actually confer differential values on sites. Land value is determined by the demand for living, working, and recreational space. It measures the advantages of a particular piece of land over that of the poorest land in use.

Land values are affected by the provision of services such as water, gas, and electricity. They are protected by the police, the fire and hospital services, and flood control. Communications (road, rail, river or sea port, aerodrome) are especially significant, and every improvement to the infrastructure will result in higher land values overall in the areas affected (though individual sites will not benefit equally, and a few may even lose value in the short run).

We notice how North America has developed in the five and a quarter centuries since Columbus; how in the U.K. the comparatively recent preference for trade with continental Europe instead of the Commonwealth

has affected the fortunes of East Anglia and Merseyside; how Aberdeen and its hinterland have been changed by the discovery and exploitation of North Sea oil and gas; how the growth of service industries and of light electronic industry at the expense of much “heavy” or “smokestack” industry has resulted in the redistribution of jobs and of people; whilst at a local level, we see how one-way streets, parking regulations, and the re-positioning of a pedestrian crossing can affect the relative attraction of competing shop sites.

The individual landowner, in his capacity as owner of land, clearly is powerless to create his own land value, although if he were also to exert labour or provide capital he would, in those distinctly different rôles, play his small part as a member of the larger community. The landowner as such, though, performs no useful function. His sole “contribution” to the process of wealth creation is to charge labour and capital for access to what Nature has already provided free, at a price which reflects the extent of past, current, and anticipated future levels of economic activity.

Values which ought rightfully to be public, have to be “bought back” from landowners before anything new can be done!

The pragmatic argument: raising revenue in an efficient, superior way

Essential government services must be paid for somehow. The advantages of LVT are that (i) it is cheap to collect; (ii) its yield is certain and potentially large; (iii) it cannot be avoided or evaded; and (iv) it does not add to the cost of living, because, as all economists agree, it falls on those who have a beneficial interest in land and cannot be “passed on” by them in the form of higher rents for occupiers or higher prices for goods or services made on, or sold from, the premises. In short, land is “price inelastic”.

The revenue raised replaces existing taxes, which fall on personal earnings and on the goods and services people provide for each other by productive effort. Work and enterprise are rewarded. Merely holding land becomes unprofitable. Landowners, obliged to pay the LVT, need to generate the necessary income. Valuable land that is unused and under-used has therefore to be put to an appropriate use.

RECAPITULATION

We are paying over land values now, but in a haphazard way and to the wrong people! Anybody renting a piece of land has obviously to pay the landowner, and site rents form part of the payments made for use of buildings. If a property is being purchased with the help of a bank or building society, the loan repayments include a land value element. Even if land is fully paid for, the freeholder has to carry an “opportunity cost” which is the income forgone through having his money tied up in capitalised land rent.

What happens to-day is that we pay land values, which rightfully are public, to the private landowner, and then suffer taxes on our private earnings, goods, and expenditure, to finance public needs. It is ridiculous. Landowners are not to blame: but the system of landlordism, is.

Land values are not Government’s to give away. Morally they belong to us all equally and in theory could be paid out on a per capita basis as a sort of reverse poll tax. For convenience we argue that Government retain what is needed to cover essential public revenue requirements and only then distribute the balance.

The moral basis for LVT is payment for benefits received.

The landholder pays a duty in return for exclusive enjoyment of the natural and social advantages of his site. What he achieves thereafter, he is free to enjoy untaxed.

Land has its own ability to pay : its value is derived from and reflects its capacity to produce a return with the appropriate investment of labour and capital. In this way LVT restores meaningful recognition that all land is vested in the Crown so that Land-Rent thus becomes available to H.M. Government.

Land value is the one thing that should never be privatised.

A National Land-Rent Charge (LVT) is good politics and good economics. Perhaps above all, it is based on sound ethics.

LVT THE HOLISTIC LAND-RENT CHARGE

Holism is

the tendency in nature to form wholes that are more than the sum of the parts by creative evolution. One is not too sure about that “creative evolution” bit; but in political economy almost everything affects land value and LVT therefore beneficially affects almost everything. Let us look…

(i)

LVT, in its local guise of SVR, can replace both the council tax and the UBR, encompassing vacant and derelict land but excluding the value of all buildings and other developments. There is no reason to stop here. One can go beyond this and collect sufficient revenue to replace centrally distributed grants to local authorities as well. Even so, LVT risks being wasted if considered as just a little local tax, for it does much more.

(ii)

It is increasingly acknowledged that spending on infrastructural developments, by government bodies and private undertakings alike, leads in general to substantial increases in the value of land in the surrounding neighbourhoods. Improvements in passenger transport facilities are particularly evident examples. Whilst LVT is admitted to be a highly suitable means of capturing this land value to defray project costs, it is frequently forgotten that LVT is not to be treated as a means of collecting only increments in land value but all pre-existing land value too, and is not merely to be used towards financing part, or even all, of a single project, but as the fundamental source of income for the public revenue.

(iii)

LVT is similarly cited as applicable to regeneration plans, usually in an urban context and frequently in relation to the long-standing and vexed question of recovering “planning gain”. LVT does of course do this and, being related only to site value, it also rewards good development and penalises under-development. In a seeming paradox, it acts to render over-intensive development (expensive high-rise office blocks, lots of little houses cramped together) much less likely. The present system tolerates withholding and under-use of land, which makes it scarcer and dearer, obliging developers to resort to essentially uneconomic over-exploitation.

(iv)

LVT, then, is not to be viewed as a mere financial measure, a better way of revenue-raising. It is, to be sure, better to collect the national land-rent than it is to levy taxation on production, earnings, goods, services, and savings. The consequences of a deliberate move to full operation of LVT go beyond finding a different way to fill the Chancellor’s coffers, however.

(v)

Collecting the rental value of land as close as is possible to the theoretical maximum 100%, leaves bare land with practically no selling value, since the capitalisation of a theoretically 0% rental stream which the landholder can retain, is zero. Land is worth holding only for use, and for appropriate good use to boot. Speculation in land is killed stone dead. Whereas speculation in goods can do little harm, since withholding products from the market will stimulate further production at home and encourage imports from abroad, and may well be beneficial in making supplies available later if and when a genuine shortage occurs (think of the oil trader laying in stocks of heating oil against an especially cold winter), land is a natural monopoly, and its hoarding must always lead to artificial scarcity and diseconomy.

(vi)

Housing is affected in many ways by adoption of LVT. Apart from the benefits deriving directly from what has been said above, shifting taxes off labour and capital, and off goods, including houses, means that buying a home no longer means shelling out to buy the land (in south-east England, half of the cost or more), but just the building, fencing, driveway, and any special improvements such, perhaps, as to the garden). Any mortgage required is for a much lower sum. The only outgoings are repayment of this now lower mortgage and meeting the land-rent charge (LVT demand).

(vii)

The mechanism of the cycle of boom and slump depends crucially on the rôle of land in the functioning of the economy. In essence, private appropriation of the rent of land leads, in a rising economy, to land speculation, to over-building to justify the rising cost of over-priced land, and to over-lending by banks on the illusory security of the rising spiral of land values – up to the point at which the bubble finally bursts. When site rents are paid to the national exchequer, private profit can be made only from the activities of labour and capital. Undistracted by the call of speculative takings from land dealing, the economy grows in an orderly manner, with the rewards of enterprise and effort going to those responsible for producing them.

(viii)

Apart from what is needed to ensure capital formation, created wealth is distributed to labour as wages and as rent to landowners. Because basic wages are set at the economic margin, and because that margin is artificially depressed by widespread under-use and withholding of land, wages are far lower than they ought to be. Most wage takers receive little more than they need to keep themselves and their families in something ranging from bare respectability to a reasonable comfort. Consequently they have little or no scope to set aside savings and become significant owners of capital. Thus it is that the owners of land (private persons, trusts, and bodies corporate) also own most of the capital. The assessment and collection of land values in place of present-day taxes will ensure that those who actually perform work become the chief providers of new capital.

(ix)

How can there be unemployment, other than transient? Men are idle, wanting to work. Capital too lies idle, rotting by the day. If people cannot supply, they cannot effectively demand. If the problem does not lie with labour or capital, it must lie with land. In fact, insufficient land is available on affordable terms. Land stands unused or under-used. Furthermore, Government lurks by to impose job-destroying taxes on labour and capital. LVT not only replaces those taxes but obliges landholders to put their land to use to generate the income to meet the land value duty.

(x)

Imbalance in regional development is not a question of capital investment or of labour productivity; it is a matter of location. Northern Ireland, much of Scotland, much of Wales, and indeed large areas of England, lie on the periphery, distant from the economic concentration in London, the south-east, and the continental EU. Land values are normally lowest at the outer fringes, reflecting those regions’ geographical and other disadvantages as compared with the centre. To-day’s taxes like PAYE, VAT, and motor fuel duty take no account of this, and at the margin tip potential wealth creation into unprofitability. LVT, however, by definition, bears lightly at the fringes, and creates tax havens exactly where they are wanted most.

LVT – collection of the national land-rent – is not just a tax policy, not just a useful tool to stimulate urban (and rural) regeneration or help pay for a new transport scheme, or any other item we have mentioned, or, indeed, have left unmentioned here. It is much more – a holistic remedy that will fully reward the attention devoted to its establishment and nurture to fruition.

PROPERTY AND THE PROPERTY BUSINESS

The property business, as the term is widely understood, is not about movable personal property. It covers that which is regarded as fixed, immovable – houses, factories, offices, shops, farms, mines, warehouses, airports, for example, together with their underlying and surrounding ground. ‘The property business’ in fact is a catch-all expression, lumping together at least four groups of participants. Landowners sell or lease out the site. Financiers organise the funds to support the land acquisition and construction costs. Constructors bring men and equipment to the site and organise and direct the building work. The professionals are those who actually carry out the work – the architects, surveyors, engineers, skilled craftsmen, general labourers, and, when all is done, the property managers.

The financiers, constructors, and professionals all perform work, by hand or brain. In the terms of political economy, they provide Labour. Some, from the plumber with his own specialised tool kit to the great civil engineering company with its cranes and bulldozers, will also provide Capital, which is to say goods previously manufactured not for direct consumption but for use in further Wealth creation. Finance comes from private savings via banks and from the resources of such as insurance companies, trusts, and pension funds. The money thus supplied is a Wealth token, representing its owners’ temporary denial of gratification through consumption so that it may be used in investment, in the business of making and furnishing a building. Labour is work. Capital is a form of stored and re-circulated Labour. For all their differences and their internal divisions, financiers, constructors, and professionals represent current and past Labour.

What of the landowner? Land was not man-made. It was provided free by dear old Mother Nature. If, in the present context, we rightly disallow the ownership of Labour (chattel slavery), the crucial distinction in economics is that between Land and Capital. If Land is withheld, Capital, as well as Labour, is locked out, and can produce nothing. Each plot constitutes a monopoly location: Land is not transportable from place to place. Property and property values are imprecise terms, misleading in economic analysis.

The Land interest is mostly at odds with Labour and Capital, and has most to gain from the confusion. Of course we know that one person or one body corporate may perform more than one function or indeed all three (a man may own Land and provide his own Capital and perform his own Labour) but in political economy the functions are distinct, and require to be considered differently and separately. Capital and its value are private, and so too are the rewards of Labour. The value of Land comes from the economic attraction of the location, which in turn stems from natural advantage and the general presence and activity of people. Land value is public. Landowners do not want attention drawn to that; and the British Property Federation has yet to admit to recognition that the dichotomy exists, let alone decide whose side it is on!

THUMPING THE TUB

We end, not with a plea for reason, because we have been doing that throughout two special Issues, so here goes a cry to arouse some action.

The infrastructure the public provides and whose integrity Government largely guarantees in so many ways, is a massive gift to holders of land title deeds. What would a land title deed be worth without the courts to uphold it and the police and military to enforce it? What would land be worth without roads, railways, ports, gas, electricity, water and sewerage, and basic social services such as hospitals, schools, and fire and postal services? What would land be worth without the organs of government to provide for everything from defence of the realm to collection of household rubbish? What would land be worth without all the organisation of businesses to support the production and distribution of wealth? Change, sudden or creeping, of economic and demographic factors occurs and land values shift accordingly; yet landowners have no power to “produce” their own land value or even to maintain it or hold back its erosion. They make nothing. They just take – and contemporary society lets them get away with it!

************************************************************************************************

Published by the Land Value Taxation Campaign,

54, Woodway, Hutton, Brentwood, Essex, CM13 2JR,

and distributed free to selected members of both Houses of Parliament, of the European Parliament,

of the Scottish Parliament, the National Assembly for Wales, and the Northern Ireland Assembly.

Internet http://www.landvaluetax.org

Articles

Land Value Tax Links

The Tax Burden

Article List

- Welcome

- SA 88. Is there another way? by Tommas Graves

- SA 87. Time for a look at Rent by Tommas Graves

- SA 86. It’s rather Odd………….. By Tommas Graves

- SA85. Born to become a Georgist by Ole Lefmann

- SA84. Happy Nation by Lasse Anderson

- SA83. Ulm is buying up land, sent by Dirk Lohr

- SA82. Radical Tax Reform by Duncan Pickard

- SA 81. All taxes come out of Rents, by Rumplestatskin.

- SA 80. The Housing Crisis and the Common Good, by Joseph Milne

- SA 79. The “housing crisis” is no such thing, by Mark Wadsworth

- SA78. The Inquisitive Boy by “Spokeshave”

- SA 75. A Note on Swedish Taxes, by Tony Vickers MScIS MRICS

- SA 74. Homes Vic by Emily Sims

- SA73 Public Revenue Without Taxation by Peter Bowman

- SA71. Two presentations by Ed Dodson

- Short Sighted Benevolence

- SA 72. CAN YOU SEE THE CAT?

- SA70. Dissertation on Land Rental by Marion Ray

- Verses on the theme

- SA69. Argentina by Fernando Scornic Gerstein

- SA68. The Right to Work, by Leslie Blake

- SA66. The Most Wonderful Manuscript by Ivy Akeroyd 1932

- SA65. Housing Crisis? What Housing Crisis? by Mark Wadsworth

- SA64. Making Use of History by Roy Douglas

- SA63. The Fairhope Single Tax Colony – from their website

- TP35. What to do about “The just about managing” by Tommas Graves

- SA62. A Huge Extra Resource, by Ed Dodson

- SA61. Foundations of Earth Sharing Why It Matters: By Lawrence Bosek

- SA60. How to Restore Economic Growth, by Fred Foldvary, Ph.D.

- Two cartoons by Andrew MacLaren MP

- SA59. The Meaning of Work, by Joseph Milne

- SA 58. THE FUNCTION OF ECONOMICS, by Leon Maclaren

- SA 57. CONFUSIONS CONCERNING MONEY AND LAND by Shirley-Anne Hardy

- SA 56. AN INTRODUCTION TO CRAZY TAXATION – by Tommas Graves

- SA 55. LAND REFORM IN TAIWAN by Chen Cheng (preface) 1961

- SA54. Saving the Commons in an age of Plunder – by Bill Batt

- SA53.- Eurofail – VAT, by Henry Law

- SA52. Low Hanging Fruit – by Henry Law

- SA51. Location Theory and the European Union, – by Peter Holland

- SA50. Finland’s Basic Income – why it matters by Fred Foldvary, Ph.D.

- SA 29. A New Model of the Economy, by Brian Hodgkinson, as reviewed by Martin Adams of Progress.org

- Economics Explained (In 1 Simple Cartoon)

- SA 48. LANDED (Freeman’s Wood) by John Angus-StoreyG2

- SA 47. Justice and the Common Good by Joseph Milne

- SA 49.Prosper Australia – Vacancies Report

- SA39. A lesson from Alaska: further thoughts? By Alanna Hartzog

- SA23. Taxation: a brief history by Roy Douglas

- SA45. Of course, it wouldn’t solve all problems………by Tommas Graves

- SA43. TIME TO CALL THE LANDOWNERS’ BLUFF by Duncan Pickard

- SA44. Answering questions to UN Habitat 3 Financing Urban Development by Alanna Hartzog

- SA15. Why we don’t have a Housing Shortage, by Ben Weenen

- SA27. Money and Natural Law, By Tommas Graves

- SA42. NO DEBT, HIGH GROWTH, LOW TAX By Andrew Purves

- SA40. High Land Prices and Rural Unemployment, by Duncan Pickard

- SA28. Economics is a Natural Science by Duncan Pickard

- SA34. Economic Answers to Ecological Problems by Seymour Rauch

- SA22. Public Revenue without Taxation by David Triggs

- SA41. WHAT FAMOUS PEOPLE SAID ABOUT LAND contributed by Frank de Jong

- SA36. TAX THE RICH? Pikety and all that……..by Tommas Graves

- SA46. LAND VALUE TAX: A VIABLE ALTERNATIVE By Henry Law

- SA35. HOW CAN THE ECONOMY WORK FOR THE BENEFIT OF ALL? By Peter Bowman, lecture given at the School of Economic Science.

- SA38. WHO CARES ABOUT THE FAMILY by Ann Fennell.

- SA30. The Turning Tide: The Beginning of Monetary Trade in Anglo-Saxon England by Raymond Makewell

- SA31. FAULTS IN THE UK TAX SYSTEM

- SA33. HISTORY OF PUBLIC REVENUE WITHOUT TAXATION by John de Val

- SA32. Denmark By Ole Lefman

- SA25. Anglo-Saxon Land Tenure by Raymond Makewell

- SA21. China – Four Thousand Years of Taxing the Land by Peter Bowman

- SA26. The Economic Philosophy of Georgism, by Emma Crosby